Healthier economy may delay interest rate cuts in a blow for borrowers

The Office for National Statistics said gross domestic product, or the output for the economy, increased by 0.4 per cent in May

The UK economy grew quicker than expected in May but this could lead to a further delay in the Bank of England cutting interest rates in another blow to borrowers.

The Office for National Statistics said gross domestic product increased by 0.4 per cent in May, exceeding predictions of 0.2 per cent in growth, as more shoppers returned to high streets and construction work recovered.

It came after no growth was recorded in April, with damp weather hitting consumer spending.

However, the more positive economic outlook and concerns about inflation could convince policymakers on Threadneedle Street not to tinker with interest rates when they next meet in August.

Suren Thiru, economics director at The Institute of Chartered Accountants (ICAEW) said: “These figures confirm a robust rebound in economic activity as stronger services and construction output helped return the economy to growth.

“May’s GDP uptick may well have been followed by a June washout, with wet weather likely to have stifled output from key sectors of the economy, despite a helping hand to hospitality and some retailers from Euro 2024.

“Longer-term, the new government faces an uphill struggle to achieve its ambition to significantly uplift the UK’s growth trajectory, unless it can substantially increase productivity and tackle economic inactivity.

“These GDP figures may make an August rate cut less likely by providing those rate setters, who are concerned about underlying price pressures, with sufficient confidence about the UK’s economic recovery to continue putting off loosening policy.”

Ashley Webb, UK economist at Capital Economics said the stronger than anticipated GDP forecast means that the Bank does not need to rush to cut interest rates.

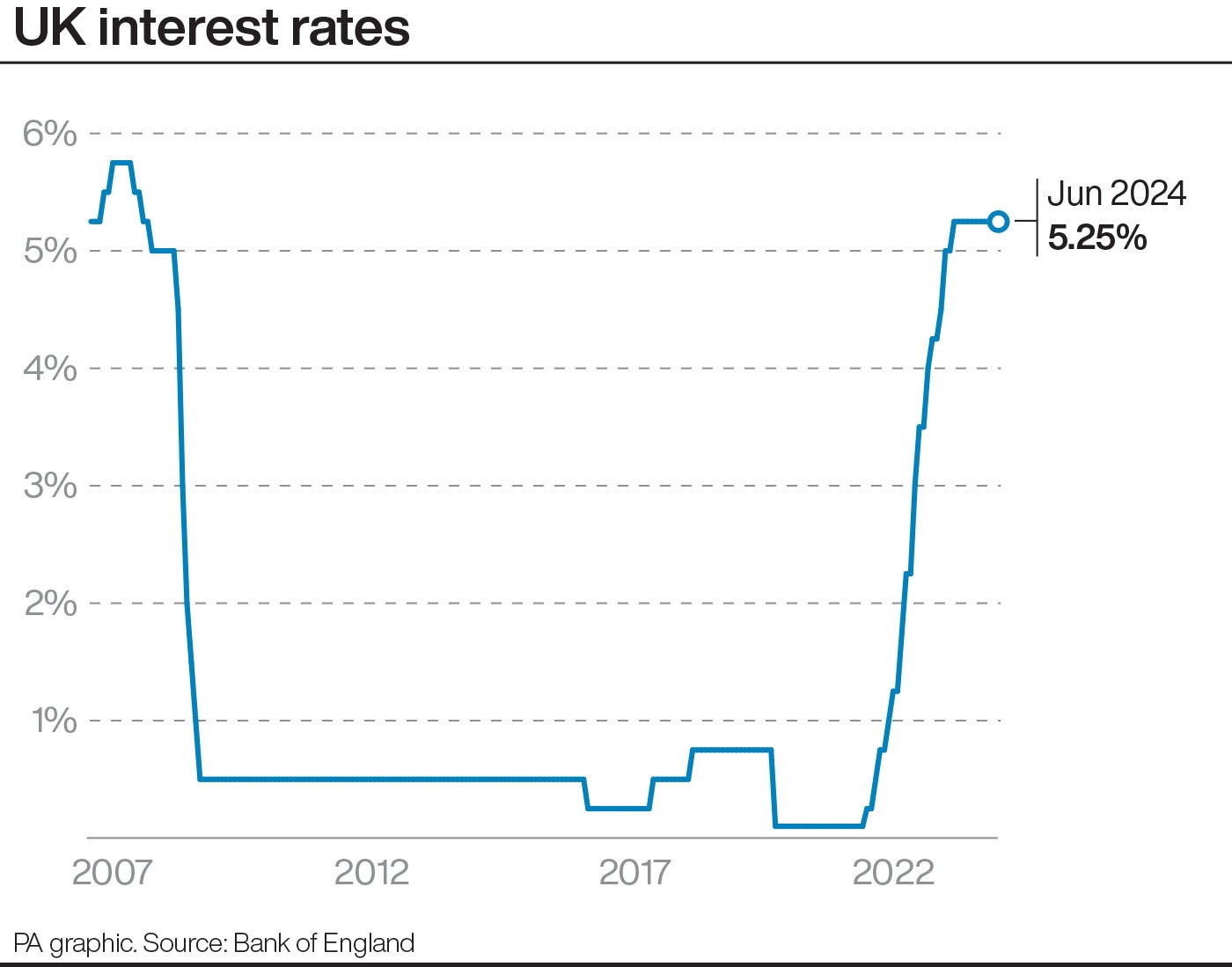

He said: “We still think the Bank will cut interest rates from 5.25 per cent to 5.00 per cent at the next policy meeting in August, although the timing of the first cut will be heavily influenced by June’s inflation and May’s labour market data releases next week.”

In April, the economy flatlined after a 0.4 per cent month-on-month rise in March due to wetter weather, according to the Office for National Statistics.

Growth was driven entirely by the services sector, with information technology and the professional and scientific sectors expanding rapidly.

Between January and March, UK GDP grew by 0.7 per cent. That growth saw the UK economy rebound from a recession in the latter half of 2023.

ONS director of economic statistics Liz McKeown said: “The economy grew strongly in May, with all the main sectors seeing increases.

“Many retailers and wholesalers had a good month, with both bouncing back from a weak April. Construction grew at its fastest rate in almost a year after recent weakness, with housebuilding and infrastructure projects boosting the industry.”

In June, inflation also fell back to the 2 per cent target for the first time in nearly three years. The Office for National Statistics figures show the Consumer Prices Index (CPI) dropped to 2 per cent in May, down from 2.3 per cent in April.

The new figure marked the first time inflation was at the Bank of England’s target since July 2021, before the cost-of-living crisis saw inflation shoot up – at one stage hitting levels not seen for 40 years.

In the first week since Labour’s election landslide, the chancellor, Rachel Reeves, promised to reboot the economy by making it the new government’s “national mission” to secure the highest sustained growth in the G7.

Ms Reeves said: “Delivering economic growth is our national mission, and we don’t have a minute to waste.

“That is why this week I have already taken the urgent action necessary to fix the foundations of our economy to rebuild Britain and make every part of Britain better off. A decade of national renewal has begun, and we are just getting started.”

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments